With customers seeking convenience and 24*7 service accessibility, going digital is no longer a choice for banking businesses. The shift from traditional banking to online banking enhances user experience, streamlines internal operations, minimizes costs, and reduces manual intervention.

Considering these benefits and to stay competitive, global banks are seeking online banking software development companies that can understand their unique requirements and build customized and scalable software solutions.

However, before connecting with any such company, it is crucial to comprehend various aspects of online banking software. And this comprehensive guide covers them all. Let’s delve deeper to understand the types, features, challenges, and development process of online banking software.

What is Online Banking Software?

Online banking software offers a digital platform that enables customers to access banking services over the Internet. From managing bank accounts, conducting transactions, and bill payments to applying for loans and managing credit/debit cards, customers can do everything from the comfort of their homes.

Online Banking Software Development

Creating customized, scalable, and secure software that allows users to access banking services is what comes under online banking software development. There is a proper step-by-step procedure that needs to be followed to ensure the successful creation of such software. This procedure has been discussed in further sections of the blog.

Online Banking Software Development: Market Statistics

With the growing adoption of mobile and web-based technologies in the banking industry, the demand for banking software development is surging. Here are a few statistics supporting this statement:

- The global banking software development market is forecasted to reach USD 69.9 billion by 2032.

- Continuous technology innovations and advancements, increasing customers’ demand for efficient banking services, the need to adhere to regulatory requirements, and emerging market opportunities are key drivers of this development.

- Approximately 71% of customers manage their bank accounts via a mobile application or laptop.

- The same report by ABA highlights that 79% of customers believe digital technologies make banking services more convenient and accessible.

6 Reasons Why Build an Online Banking Software

Here is why banking organizations need to invest in banking software development:

- To achieve operational efficiency, accuracy, and excellence through automation.

- To enhance security by integrating advanced security measures and fraud detection systems.

- To improve customer services by making banking services round-the-clock accessible and adding personalization.

- To analyze customers’ banking preferences, financial goals, and market trends for data-based decision-making.

- To scale with evolving customers’ requirements, explore new market opportunities, and stay competitive.

- To ensure complete compliance with regulatory laws and standards.

Apart from the above, there could be other reasons that a bank might choose to develop online banking software and bring digital transformation to the sector.

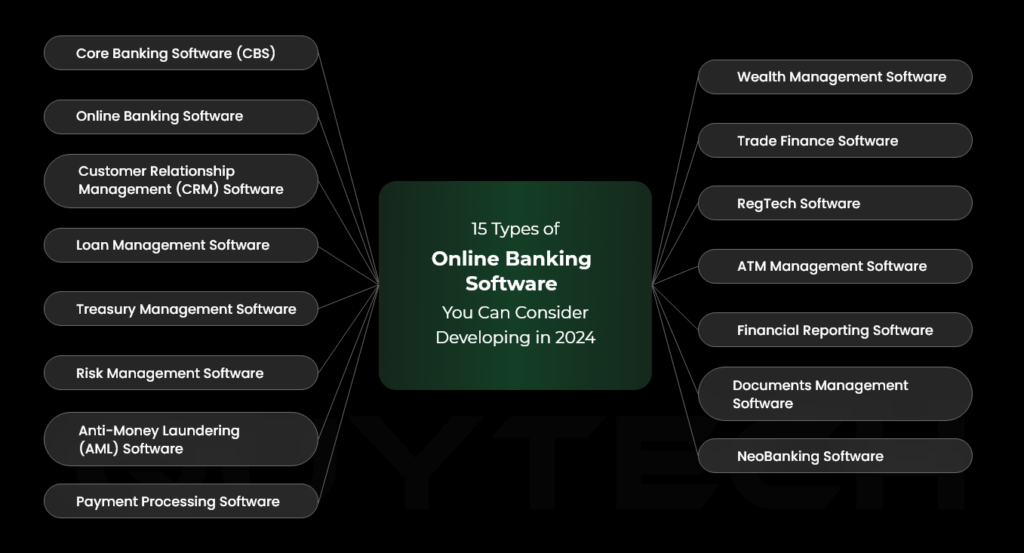

15 Types of Online Banking Software You Can Consider Developing in 2024

Banks can invest in different types of online banking software to fulfill various requirements. They can choose to build on-premises or cloud-based banking software. The former can be accessed only on authorized devices with specific configurations, whereas the latter can be accessed from any device, providing it has internet connectivity and authorized access.

#1 Core Banking Software (CBS)

With a CBS, banks can streamline essential banking operations, such as account management, transaction processing, customer information management, and ledger management. A cloud-powered CBS can even centralize banking operations, increasing transparency, accessibility, and data updates across all branches.

#2 Online Banking Software

Also known as electronic banking software, this type of software enables customers to access their bank accounts online via different channels. They can check account balances, make transactions, pay bills, manage credit cards, and enjoy various other banking services.

#3 Customer Relationship Management (CRM) Software

Developing CRM software can assist banks with managing customer interactions and extracting crucial customer data required for customer retention and building long-term relationships.

#4 Loan Management Software

With such software, banking organizations can streamline end-to-end loan processes, ensuring accuracy and transparency, minimizing turnaround time, automating document verification, and verifying compliance with regulatory requirements.

#5 Treasury Management Software

A bank can also develop online banking software to manage their cash flow, liquidity, investments, risk exposure, and more. The software can help the bank handle financial risks effortlessly.

#6 Risk Management Software

With risk management software development, banking organizations can effortlessly identify, evaluate, and monitor credit, market, liquidity, and operational risks, protecting their financial stability.

#7 Anti-Money Laundering (AML) Software

For any bank, it is mandatory to adhere to anti-money laundering regulations and laws. A bank can ensure the same by creating anti-money laundering software that allows it to monitor transactions, identify suspicious transactions, and minimize the risk of financial fraud.

#8 Payment Processing Software

This software is primarily dedicated to facilitating seamless and secure processing of different types of payments, such as ACH transfers, wire transfers, and credit/debit card transactions.

#9 Wealth Management Software

With wealth management software, banks can efficiently manage their investment portfolios, advisory services, and financial planning to improve their portfolio performance and net worth.

#10 Trade Finance Software

The core functionality of the trade finance software is to allow banks to streamline trade finance operations while adhering to international trade regulations. These operations include managing document collection, letters of credit, trade loans, etc.

#11 RegTech Software

Regulatory compliance software makes sure that a bank’s operations comply with local and international regulatory requirements for data protection, anti-fraud, and more. It minimizes the risks of penalties.

#12 ATM Management Software

ATM management software empowers banks to manage a network of ATMs to handle transactions, check cash levels, and schedule maintenance. It ensures efficient ATM operations and minimizes downtime.

#13 Financial Reporting Software

This kind of software allows the seamless generation of financial reports to maintain balance sheets and income and cash flow statements and support data-backed decision-making.

#14 Documents Management Software

Banks can invest in document management software to minimize manual intervention for paperwork such as managing KYC documents, loan papers, and admin reports. This not only saves time, resources, and effort but also brings precision to the work done.

#15 NeoBanking Software

An online-only banking can develop NeoBanking software to manage all their banking operations and offer banking services to customers. This type of online banking software can do everything from account management and credit/debit card management to paying bills and transferring funds.

You might also be interested in exploring the Best Finance App Ideas to Launch Your Startups in 2024.

Technology Stack for Developing Online Banking Software

Choosing the right technology stack is imperative for the successful development and long-term success of the banking software solution. It also ensures the software serves its exact purpose. Selecting the same depends on the type of banking software you are building. Some common technology considerations include:

| Programming Language | Python, JavaScript, Java, C/C++, etc. |

| Frameworks | React, Django, Ruby on Rails, etc. |

| Databases | MongoDB, MySQL, PostgreSQL, etc. |

| Cloud | GCP, Azure, AWS |

Online Banking Software: The Development Process

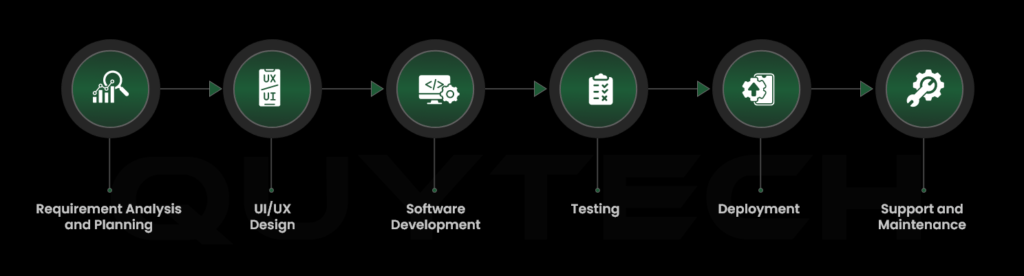

Most experienced online banking software companies follow a step-by-step online banking software development process

1. Requirement Analysis and Planning

The first step involves collecting project requirements and understanding the client’s unique challenges and expectations from the software. Besides, outlining the software’s features, functionalities, and compliance requirements is also a part of this step. The fintech developers then do a feasibility study and prepare a detailed project plan with timelines, milestones, and project management strategies.

2. UI/UX Design

Designing the software architecture, databases, servers, APIs, and security protocols, creating wireframes to have an idea of the final look and appeal of the software, and preparing detailed technical design is covered under the UI/UX design.

3. Software Development

The development process includes building front-end and back-end components to build the client-side application and develop server-side logic. This phase also incorporates integrating third-party services and implementing security techniques and required compliances such as PCI DSS and GDPR.

4. Testing

Testing is the most crucial phase of online banking software development. It includes conducting unit testing to validate the functioning of each component, integration testing to verify the functionality of all modules and services, and system testing to ensure the software meets your requirements. The phase also includes implementing security testing and user acceptance testing to make sure the software works as expected on all platforms.

5. Deployment

In this step, the team of fintech developers set up the servers, databases, and network configurations to begin migrating data from legacy systems to the newly developed software without compromising data integrity and security. It also involves training the employees to make them familiar with each component, feature, and functionality of the software.

6. Support and Maintenance

The last phase of digital banking software development includes monitoring the software for performance, security, bugs, updates, and enhancements. It also involves collecting user feedback and making necessary changes for improvement.

Regulatory Compliances and Security Standards Required for Successful Online Banking Software

Regulatory compliances and security standards that are mandatory to build online banking software may vary from country to country or geography to geography. However, some common ones include the following:

Regulatory Compliance

- General Data Protection Regulation (GDPR)

- Payment Card Industry Data Security Standard (PCI DSS)

- Anti-Money Laundering (AML)

- Know Your Customer (KYC)

- Electronic Funds Transfer Act (EFTA)

Security Standards

- ISO/IEC 27001

- ISO/IEC 20022

- BASEL III

- Compliance for digital identity, electronic signature, etc.

Digital Banking Software Development: Features You Can Add To Make It Stand Out

Features of online banking software mainly depend on its type; however, there are some common features that you need to implement in all of them. Here is the list of those features:

Online Banking Software Features- For Banks

User Management and Access Control

With this, admins can define user roles and permissions to validate only authorized users to access the software for defined purposes or functions. They can also set controls and add an additional layer of security to protect sensitive data from unauthorized access.

Customer Account Management

Seamless account creation, management, and closing is what this feature is all about. It enables banks to manage everything associated with customers’ accounts.

Transactions Management

This significant feature of online banking software facilitates seamless fund transfers, including internal, interbank, and international. It also enables banks to process different types of payments securely.

Security and Fraud Prevention

Powered by AI and ML, this feature empowers banks to monitor transactions in real-time to avoid fraudulent transactions. With this, they can also safeguard stored data and the data used for executing transactions.

Customer Relationship Management (CRM)

Efficient management of customer relationships is crucial for the success of any bank. An online banking software with a built-in CRM or integration with an external one through APIs can address customers’ queries and issues seamlessly.

Reporting and Analytics

This feature empowers banking personnel to generate comprehensive financial reports to understand financial performance and calculate profits or losses. Based on these reports, banks can improve their strategies. Analytics offers insights into customer behavior, transaction patterns, and product/service usage, enabling data-driven decision-making.

Regulatory Compliance

An online banking software with a regulatory compliance feature empowers bank professionals to verify that all transactions and operations comply with required regulations, avoiding non-compliance penalties. This feature also helps to manage audit trails to ensure complete transparency.

Loan and Credit Management

With this feature of online banking software, banks can streamline loan and credit management to offer quick and efficient services. They can also assess the creditworthiness of customers before giving loans or credit.

Notifications and Alerts

The notifications and alert feature notifies customers of activities associated with transactions, bank accounts, upcoming payments, etc. It plays a pivotal role in achieving customer satisfaction.

Online Banking Software Features- For Customers

Account Overview

This feature offers quick access to check all your accounts to know the balance, recent transactions, and other activities.

Funds Transfer

With this feature, users or customers can seamlessly make transactions within the same or other bank accounts. For a better experience, banks can also provide options like scheduled or recurring transfers.

Bill Payments

It allows users to pay for their utility and credit card bills and other expenses straight from the online banking software. They can even set an auto-payment for recurring digital payments to avoid penalties.

Check Deposit

This feature allows users to deposit checks even without visiting a branch. Wondering how? It simply requires a user to upload a picture of the check and after verification, the bank will process the payment.

Budget Management

Advanced online banking software enables its users to track and manage their budgets to help them align with their financial goals. Users can get crucial insights about their spending habits for better planning.

Real-time Alerts and Notifications

With this feature, users can get immediate alerts for account logins, transactions, low balances in their accounts, and more. On one side, it keeps users updated with their finances, on the other side, it prevents unauthorized access to their accounts.

Two-factor Authentication

The feature enhances the security of a user’s account by enabling them to provide a one-time password or do biometric authentication every time they want to access their account using the software.

Customer Support Services

This is one of the most essential features of online banking software. It allows customers to reach out to professionals in case of any query or quick help like blocking credit cards, reporting an unauthorized transaction, or simply getting information about applying for a loan.

Please note that the features of online banking software may vary based on the software type or its purpose of development. You can reach out to a professional online banking software development company to have a better understanding of this and other aspects of online banking software development.

Top 09 Trends in Online Banking Software Development

Now that you know the step-by-step online banking software development process, let’s walk you through the future trends that can ensure the long-term success of the software.

#1 Artificial Intelligence and Machine Learning

While both these technologies have already been used, for personalization, virtual support by chatbots, and understanding customer preferences, in banking software for quite a long time, we will witness their unique use cases, including the following:

- Predicting customer churn rate

- Monitoring transactions in real-time

- Offering financial advice through robo-advisors

- KYC automation

Read more: AI in Banking: How AI is Disrupting the Banking Industry

#2 Blockchain Technology

The use of blockchain technology in online banking software will also increase beyond enhancing security and digital ID verification. Online banking software development companies might use blockchain for the following purposes:

- Ensuring adherence to Anti-money Laundering (AML) Compliance

- Automate the execution of loan agreements through smart contracts

- Conducting interbank settlements

- Storing immutable records for audits

#3 Biometric Authentication

Banking software will mandate the use of biometric authentication, i.e., facial recognition, voice recognition, or fingerprints, to allow only authorized users to use the software. It will also improve convenience and accessibility by minimizing the need for entering passwords and PINs for signing in.

#4 Open Banking

Open banking is an emerging trend in the banking industry that allows banks to seamlessly collaborate with third-party providers via API integrations. It enables them to offer new services and products without developing them from scratch.

With open banking, banks can extend their capabilities and deliver an unparalleled customer experience by allowing customers to share their financial information with third-party apps for better financial management.

#5 NeoBanking

NeoBanking is another major trend popular in the banking industry. Neo banking operates only online and doesn’t have any physical branch where customers can visit for account management, make transactions, and access other banking services. The bank operates using online banking software that both parties (bank professionals and customers) can use to offer and access banking-related products and offerings.

#6 Cloud Computing

Cloud computing is one of the fastest-growing trends in the banking industry. Banking organizations are now interested in developing cloud-based online banking software development that can be accessible from anywhere without requiring specific configuration.

Cloud-powered online banking software is easy to scale and offers secure data storage and processing. Besides, disaster recovery is easy in such software.

#7 Internet of Things

The IoT technology enables location-based authentication and transaction alerts to add additional security to the banking software. Besides, we can also see banking software to utilize IoT capabilities for:

- Monitor the status of ATMs, such as cash levels, malfunctioning, and security breaches.

- Energy management in banks

- Smart surveillance in ATMs and bank branches

- Managing and monitoring inventory, cash supplies, and other materials in the bank

#8 RegTech

Regulatory technology is one of the buzzwords in the banking industry. Businesses interested in banking software development are implementing RegTech for compliance automation, ensuring each process adheres to the regulatory requirements. Another key advantage that banks can leverage by using RegTech is to ensure their reporting tools stay compliant with evolving regulatory standards and laws.

#9 Big Data Analytics

Using big data analytics in banking software will also gain momentum. The technology helps banks to understand customer issues and offers proactive solutions. Besides, banks can also gather customer insights for targeted marketing and product development.

Online Banking Software Development: Common Roadblocks and Their Solution

Developing an online banking software solution is not easy; there could be many roadblocks to successful development.

- Security Issues

Banking software deals with confidential user data that is vulnerable to cyberattacks and data breaches. Besides, ensuring compliance with security standards can also be a challenge.

- Regulatory Compliance Challenges

Complying with complex and evolving regulatory requirements across different jurisdictions can also be a challenge in creating online banking software.

- Inability to Integrate with Legacy Systems

Integrating online banking software with different legacy systems can be difficult due to technology, data formats, and protocol differences. Similarly, transitioning or migrating data and processes from traditional banking systems to new software can also be a challenge.

- Lack of Consistency

Offering the same level of consistency in design and functionality across different platforms can be tough, especially if the banking software lacks responsiveness.

- Performance and Scalability Issues

Making the banking software capable of handling high volumes of transactions without impacting the performance is another challenge that might occur during the development. Similarly, ensuring the banking solution’s scalability could be another problem that might be caused due to poor architecture planning.

- Lack of Compatibility

Lack of compatibility means the new technologies used for digital banking software development are not compatible with the existing tech infrastructure.

How can an Experienced Online Banking Software Development Company Help Overcome These Challenges?

Professional online banking and finance software development companies plan the development process strategically considering the project requirements, choosing a suitable technology stack, and ensuring effective project management, leading to successful development.

Here is how they address the above challenges:

Implementing Advanced Security Practices

An online banking software company prioritizes security measures and invests in the latest cybersecurity technologies to ensure end-to-end security.

Knowledge of Regulatory Compliance

When you connect with a professional company for online banking software development, you can be sure that your software complies with all relevant laws and regulations, including GDPR, PCI, and more.

Expertise in the Latest Technologies

Experienced technology companies choose a suitable technology stack that facilitates seamless migration of data and processes from conventional systems to newly developed software. Moreover, they are well-versed in API integrations to integrate third-party services with your digital Banking software.

Agile Project Management Methodology

Most electronic banking software development organizations use agile project management practices to iterate quickly and respond to changes effectively, leading to high performance.

Adopt Agile Methodologies: Use agile development practices to iterate quickly and respond to changes effectively.

Scalability

By designing the architecture considering scalability and implementing cloud capabilities, online banking software development companies ensure the complete scalability of the software. They make sure the software can be scaled with evolving business requirements and as the user base grows.

Consistency across Multiple Platforms

Leading online banking software development firms run rigorous tests to ensure that the software performs exceptionally well on all platforms and devices, ensuring desired consistency.

Conclusion

With banks increasingly investing in digital technologies, the demand for online banking software is soaring. Such software helps banks streamline their internal operations, enhance customer engagement, achieve operational efficiency, and ensure top-level security. However, the success of developing such software greatly depends on the company you choose for online banking software development.

Only an experienced technology partner can understand your specific challenges and requirements and build customized and scalable digital banking software. But before finding one, it is imperative to comprehend the crucial aspects of development, including the process, challenges, benefits, types, and upcoming trends. To help you with the same, we have prepared this blog that covers everything associated with online banking software development.