The banking industry has seen a massive transformation over the past few years, mainly after the global pandemic. The rapid adoption of technologies has brought a digital transformation in the banking industry, leading to improved customer satisfaction, cost reduction, streamlined internal processes, and other revolutionary impacts.

According to Markets and Markets, the market size of the global digital banking platforms is forecasted to reach US$ 13.9 billion in 2026. While digital transformation in banking is a broad term, it is crucial to understand how it is achieved, what technologies play a key role in it, why it is important, and what areas it transforms.

We have provided this guide to help you comprehend this entire digital transformation journey. Let’s quickly begin:

What is Digital Transformation in Banking with Example?

Implementing technology in conventional banking systems to improve service delivery and enhance customer experience is what digital transformation in banking is all about. Embracing digital technologies can be attained in four ways:

- Process Automation

- Business Model Transformation

- Domain Transformation

- Culture Transformation

Example of Digital Transformation in Banking

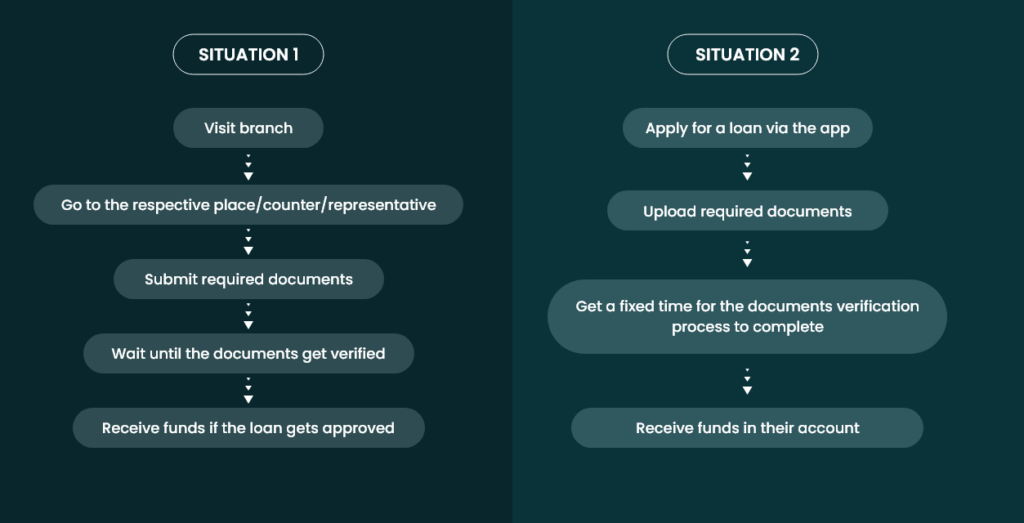

Consider a scenario where a customer wants to apply for a loan.

Situation 1:

In the traditional scenario, he/she would have to follow these steps:

Visit branch -> Go to the respective place/counter/representative -> Wait in a queue for their turn -> Submit required documents -> Wait until the documents get verified -> Receive funds if the loan gets approved

The entire process may take hours or sometimes days, depending on the verification process.

Situation 2:

The customer uses a mobile banking app and applies the loan through it:

Apply for a loan via the app -> Upload required documents -> Get a fixed time for the documents verification process to complete -> Receive funds in their account

In this scenario, the customer doesn’t have to step out of their house and visit the bank. The entire process can be done from the comfort of their home and in considerably less time.

Why Does the Banking Industry Need Digital Transformation Now More Than Ever?

Like any other industry, the banking sector also requires a digital makeover. Here are some reasons validating this statement:

#1 Rising Customer Expectations

Customers, these days, expect banking organizations to focus on delivering unmatched experiences by making banking seamless and accessible. They prefer digital channels over visiting bank branches.

Online research highlights that banking organizations that pay attention to customer experience witnessed up to 15% growth in revenue and a 20% increase in customer satisfaction.

#2 Increasing Competition

An increasing number of fintech companies are giving tough competition to traditional banks. Emerging organizations offer faster, cheaper, and user-friendly services, and to beat these competitors, conventional banks need to transform their operations digitally.

As per IBM Newsroom, 57% of BFM CEOs said that gaining a competitive edge in the finance sector depends on implementing generative AI and other technologies.

You might be interested in exploring the Role of Generative AI in Finance and Banking.

#3 Need to Implement Better Cybersecurity Practices

With increasing instances of cyberattacks, adopting robust security measures is no longer a choice. Banks need to implement advanced security and data encryption techniques to protect sensitive customer data. This goal can be achieved with digital transformation.

According to a report by American Banker, many banks face multiple cyber threats, including ransomware attacks (MoveIt bug, Citrix, etc.), phishing attacks, and more.

#4 Minimizing Cost

Digital transformation brings automation to processes that are highly dependent on human resources. It means more tasks can be performed without human intervention, reducing the overall operational costs, increasing efficiency, and bringing accuracy.

An online study revealed banks can save up to 60% with digital transformation.

#5 Data-driven Decision-making

Digital transformation offers banks the ability to make data-backed decisions. They can utilize technologies like AI, ML, and Big Data analytics to capture, analyze, and make sense of unstructured and structured data. It can help improve customer experience and explore new business opportunities.

An online report by a reputed firm highlights that banks utilizing analytics and adopting data-driven decision-making methods witness up to a 10% increase in productivity.

#6 Adherence to Regulatory Compliance

For many industries, including the banking sector it is imperative to comply with regulatory requirements and laws. Digital transformation empowers banks to ensure the same through dedicated advanced compliance management systems or banking applications that come up with smart contracts where the compliances can be defined in advance.

Global financial regulators imposed around 97 fines, making a total of nearly $189 million, to financial institutions for not adhering to AML regulations, including KYC and CDD (client due diligence) and sanction violations from Jan to June 2023.

#7 The Growing Trend of Mobile Banking and Digital Wallets

With the increasing usage of smartphones, customers demand banking and financial services to be accessible from their mobile phones. Besides banking mobile apps, the use of digital wallets has also increased, making it necessary for the banking organization to go for a digital makeover.

The number of digital banking users globally is forecasted to reach 3.6 billion by the end of 2024.

#8 The Need to Improve Customer Services

With traditional banking systems, it is difficult for banking and financial institutions to handle and respond to multiple customers’ queries simultaneously. This impacts customers’ experience. The use of AI-powered chatbots can solve this problem as a well-trained virtual assistant can respond to hundreds of queries to offer them the required information or resolve their issues. This improves customer satisfaction and also makes support services accessible all day long.

Most banks acknowledged that poor customer experience has led to a loss of 20% of their clientele in 2023.

#9 The Rising Demand for Personalized Banking Services

Today’s customer expect personalization and to deliver the same, banks need to understand their financial needs, preferences, and interests. Digital transformation by enabling AI-powered banking apps and solutions can understand the same and offer critical insights based on which banks can provide personalized services.

Personalization can help banking businesses to drive up to 25% revenue growth.

#10 Streamlining Internal Banking Operations

Manual management of banking operations might not deliver the desired efficiency and precision. Moreover, it can also be time-consuming. With digital transformation, banks can modernize their internal operations, improving precision, speed, and overall efficiency.

Streamlining operations has helped a renowned bank minimize TAT by 52% and enabled it to handle over 10,000 transactions/day.

#11 Enhancing Speed and Security of Transactions

By embracing digital transformation, banks and financial institutions can speed up transactions and minimize processing time. Faster and secure transactions foster customers’ trust and build a positive reputation for the bank.

The digital payments market is forecasted to reach USD 16.62 trillion by 2028.

#12 Eliminating Operational Risks

Advanced banking management systems and fintech apps, built with AI and ML, help banks identify and mitigate operational risks by offering real-time monitoring and data-based risk assessment.

How Latest Technologies are Bringing Digital Transformation to the Banking Industry?

Integrating advanced technologies into conventional banking solutions and systems empowers bank professionals to improve productivity and operational efficiency and deliver an unmatched customer experience. Customers can also have the flexibility and convenience to access banking services anytime and anywhere. Here is how top technologies are revolutionizing the banking domain.

#1 Artificial Intelligence and Machine Learning

AI/ML in banking can be used in many ways, including offering round-the-clock virtual assistance, assessing credit scores and market risks, and personalizing customer experience. Let’s dig deeper to learn how AI and ML are revolutionizing the banking world.

Use cases of AI and ML in banking

Detecting Frauds: AI and ML can evaluate transaction patterns to identify and prevent fraudulent activities in real-time.

Offering 24*7 Customer Support: AI-powered chatbots and virtual assistants can be used to offer 24/7 customer support, respond to customers’ queries, and perform daily operations.

Assessing Credit Scores: AI algorithms, when implemented into banking apps and solutions, can analyze various data points and check creditworthiness, leading to more precise credit scoring.

Delivering Personalized Banking: AI and ML can analyze enormous amounts of customer data and their interests in various banking services, loan requirements, and more. Based on the data, the technologies can deliver analytics that help in offering personalized financial advice and product recommendations to customers.

Managing Potential Risks: AI-powered banking apps and solutions can forecast market trends and potential risks, leading to better decision-making.

Identifying Anti-Money Laundering (AML): Machine learning helps in identifying suspicious transactions and potential money laundering activities.

Automating Operations: Implementing artificial intelligence into the banking industry automates repetitive and time-consuming tasks, such as verifying documents, entering data, segregating data, and more to enhance efficiency and employee productivity.

Analyzing Sentiments: Machine learning, when integrated into banking applications and software, analyzes customer feedback and social media interactions to understand sentiment and improve services.

Segmenting Customers: ML analyzes customer data to segment clients based on behavior and preferences for targeted marketing.

Read More: AI in Banking: How AI is Disrupting the Banking Industry

#2 Augmented Reality and Virtual Reality

Augmented reality and virtual reality technologies make the virtual world feel like the physical world. It enables users to access banking services and visit banks virtually in a way that they feel they are actually present in the bank. Here is how AR and VR are transforming the banking sector.

Use cases of AR and VR in Banking

Locating ATMs or Bank Branches: The augmented reality technology enables customers to find nearby bank branches and ATMs.

Visiting Virtual Branches: With AR technology, customers can access banking services in a virtual environment. They can also visualize banking products and services more engagingly and interactively.

Training Employees: Using virtual reality technology, banks can train employees in a lifelike environment without making them travel from one location to another.

Hosting Events: AR and VR allow banks to host virtual events and conferences to reach a wider audience and improve employee engagement while giving them a sense of connectivity.

#3 Internet of Things

The Internet of Things offers immense benefits to the banking industry by enabling wearable banking, facilitating customer data collection, and more. Let’s delve deeper to learn how IoT is revolutionizing the banking world.

Use cases of IoT in Banking

Making Smart Branches: ATMs and smart kiosks make the most of the Internet of Things technology to improve banking operations.

Facilitating Wearable Banking: With IoT-powered smart devices, bank customers can receive immediate notifications associated with their accounts and transactions.

Preventing Fraud: IoT-powered devices and cameras installed in banks can help with real-time monitoring, enhancing security and alerting for suspicious activities.

#4 Blockchain

Blockchain, with its decentralization, immutability, and transparency features, enhances security in banking applications, solutions, and software. Here are some ways blockchain revolutionizes the banking domain:

Use cases of Blockchain in Banking

Conducting Secure Transactions: Blockchain enables secure transactions by allowing only authorized persons to access the app/solution. It reduces the chances of fraud.

Automating Agreements: Blockchain offers smart contracts implementation that makes banking apps automate and enforce contractual agreements.

Facilitating Cross-border Transactions: Blockchain ensures faster and more cost-efficient cross-border transactions by improving security and implementing automation via smart contracts.

Verifying Customer IDs: With this technology, banks can easily verify customer identities, creating a secure banking environment.

Improving Compliance to Laws and Regulations: Smart contracts have the logic based on which operations are performed. In banking, it can help with ensuring all compliances are met.

#5 Cloud Computing

Cloud computing enables banking organizations to facilitate secure data sharing, improve operations, and offer seamless accessibility of their products and services. Here is how cloud computing transforms banking and its operations:

Use cases of cloud computing in Banking

Ensuring Secure Data Storage: Using the capabilities of the cloud, banks can build highly scalable and secure solutions.

Improving Banking Systems: Banking systems that are hosted on the cloud offer complete flexibility and scalability. Moreover, it also ensures seamless database recovery in case of any issue.

Enhancing CRM: With cloud-powered banking CRMs, banks can efficiently handle customer interactions and manage data effortlessly.

#6 Big Data Analytics

Big data in banking can do wonders, including getting critical insights into customer behavior, managing potential financial risks, and building effective and result-driven marketing strategies. Check out more ways big data analytics finds its way into the banking sector:

Use cases of big data in Banking

Getting Customer Insights: The technology can capture and process enormous amounts of data to offer critical insights, such as customers’ preferences and behavior, which can assist with decision-making.

Building Result-driven Marketing Strategies: With big data analytics, banks can analyze customer data to do targeted marketing campaigns, improving profitability and reach.

Improving Operational Efficiencies: Implementing big data into banking solutions can help professionals optimize banking operations by identifying inefficiencies and areas of improvement.

#7 Metaverse

Metaverse is a new concept that almost all industries are adopting to deliver an unparalleled customer experience. In the banking industry, it enables organizations to deliver interactive customer services, conduct virtual meetings, and do a lot more. Let’s check out how Metaverse is transforming the banking industry:

Use cases of Metaverse in Banking

Creating Virtual Branches: Metaverse-powered virtual branches enable customers to choose their digital avatars and visit virtual branches for different purposes, like account creation, account management, etc.

Enhancing Customer Service: The kind of virtual interaction Metaverse offers enhances customer service and experience.

Conducting Online Meetings: Metaverse, when implemented into banking apps/solutions, allows banking organizations to conduct virtual meetings and consultations.

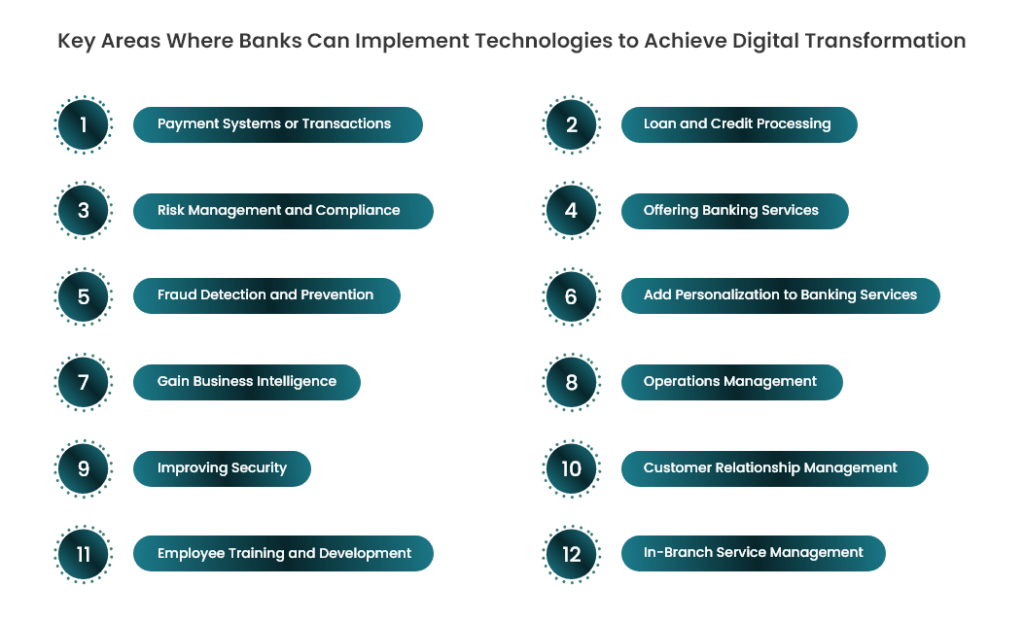

Key Areas Where Banks Can Implement Technologies to Achieve Digital Transformation

Embracing digital transformation can do wonders for banks to revamp the following operations or areas:

- Payment Systems or Transactions: It involves integrating digital wallets or real-time payment systems to facilitate quicker and more secure transactions.

- Loan and Credit Processing: Digital transformation can automate processes like loan approvals, credit assessment, and credit score evaluation.

- Risk Management and Compliance: To assess and eliminate risks, make better decisions, and ensure effortless risk management. It also involves verifying compliance with government regulations.

- Offering Banking Services: It involves building mobile and online banking apps to deliver seamless banking services and unparalleled customer experiences.

- Fraud Detection and Prevention: Banks can use technology to identify patterns and avoid fraudulent activities and cyberattacks.

- Add Personalization to Banking Services: Technologies can help businesses understand customers’ financial goals and need to offer personalization in banking services.

- Gain Business Intelligence: Implementing top technologies can help banking organizations obtain data-driven insights for better decision-making.

- Operations Management: Integrating the latest technologies can automate time-intensive operations while saving resources, costs, and effort.

- Improving Security: It includes implementing top-notch security measures and data encryption techniques to protect customer data.

- Customer Relationship Management: Tech-enabled CRM systems can facilitate seamless interactions while improving engagement with customers.

- Employee Training and Development: Banks can utilize e-learning platforms to train their employees without making them visit different places.

- In-Branch Service Management: Self-service kiosks and ATMs can also be used to improve in-branch services and, thus, customer experience.

Apart from the aforementioned ones, there might be other areas where digital transformation can do wonders. It depends on your existing tech infrastructure or the specific requirements of your banking business.

Common Challenges Businesses Face with Traditional Banking Systems

While adopting technologies for digital transformation, banking businesses may face the following challenges:

Security and Privacy Concerns

Banks deal with customers’ sensitive information that needs to be confidential at any cost. Traditional banking systems with poor security measures can be vulnerable to data breaches and other cyber attacks. These systems may not be compliant with the required regulatory requirements.

Outdated Technology

Conventional banking systems with outdated technology can make it challenging for the banking organization to keep pace with the latest industry trends. Besides, most banking institutions still rely on systems that cannot be integrated with new technologies.

Restricted Scalability

The inability to scale is one of the major challenges with traditional banking software or systems. It leads to poor efficiency and increased cost while restricting the organization from expanding its horizon and offering more services to customers.

Operational Inefficiencies

Lack of transparency, manual management of operations, and long wait times in conventional banking systems may lead to operational inefficiencies. It may also increase the overall operational cost for the banks.

Lack of Accessibility

With traditional banking solutions, organizations get limited accessibility and even their customers cannot access their accounts and banking-related services remotely. It impacts the customer experience.

How Does Digital Transformation Overcome Traditional Banking Systems’ Challenges?

With strategic digital transformation, banking organizations can address all challenges that are linked to traditional banking. They can even enhance customer experience. The first thing you need to do is to partner with a banking app or software development company that can understand your unique requirements and build a customized and scalable application or solution.

Here is how an advanced banking solution or application built using artificial intelligence, machine learning, augmented reality, virtual reality, blockchain, and other technologies can transform the entire banking operations.

Scalability

Most banking or fintech app development companies leverage cloud platforms to develop solutions that can be scaled with evolving requirements. These systems are accessible from any device, irrespective of their location.

Advanced Security Measures

Banking software development partners utilize the capabilities of AI and ML for threat detection and data encryption and implementing multi-factor and biometric authentication. It enhances the security of the software or application.

RegTech is another technology that fintech app development companies choose to ensure the banking app/solution’s continuous compliance with evolving regulations. Besides these technologies, such organizations utilize blockchain to enhance transparency, ensure end-to-end security, and bring immutability.

Automated Operations

Artificial intelligence and blockchain technology contribute to automating time-intensive manual operations, saving time and improving accuracy. Smart contracts integrated into banking solutions ensure they meet all regulatory requirements and compliance.

Improved User Experience

Banking apps/solutions built using the latest technologies ensure a consistent experience across web and mobile platforms. AI brings personalization and data-backed decision-making, AR and VR deliver lifelike banking experiences, blockchain improves security and conducts secure transactions, and more.

Up-to-Date Technology

A banking solution development organization not only leverages advanced technologies for the banking app/solution development but also offers continuous support and maintenance services that make sure the app has all the latest features and is free from bugs.

Step-by-Step Process Banks Can Follow to Embrace Digital Transformation

Here is a step-by-step process to embrace digital transformation in the banking business:

- Evaluate your current system and processes and then define a clear vision or goals for the digital transformation.

- Create a detailed technology roadmap by listing the tools and technologies you want to implement.

- Connect with a reliable fintech app development company to build banking apps, digital wallets, or banking software from scratch or upgrade your existing infrastructure.

- Conduct employee training once the new banking system is deployed or existing systems are upgraded.

- Establish a culture of continuous improvement and innovation.

- Continuously monitor the systems and collect customer feedback to make necessary improvements.

Read this blog to understand the process in detail: How to Develop a Banking App Like Bank of America.

Points to Consider While Choosing the Best Fintech App Development Company

With the market flooded with many fintech app development companies, it is critical to choose the right one. Here are some tips that can help you find the best one for your fintech mobile application or banking application or simply integrate new technologies into your traditional banking system/solution:

- Look for a partner that prioritizes customization. They will offer you solutions to your specific problems.

- Check their experience in developing fintech applications or particular types of banking apps. For this, explore their portfolio and case studies section.

- Ask the company about the security measures and NDA agreements they adopt to ensure the app/solution’s security and your data confidentiality.

- Read their client reviews and testimonials to understand their technical expertise project management ethics, delivery timelines, and other crucial aspects of fintech app development.

- Make sure the company complies with regulatory requirements and also understands all the compliance required to be met for a banking application or solution.

- Assess their ability to scale and handle future upgrades. For this, you can check for after-launch support and maintenance services.

These tips will help you connect with a suitable company for your fintech application development or bring digital transformation to the banking industry.

Conclusion

Driven by rising customer expectations, growing use of mobile technology, the need to adopt top-tier security measures, increasing focus on delivering personalized banking services, and a few other factors, digital transformation in the banking industry has been gaining momentum over the past few years.

Technologies like AI/ML, blockchain, Metaverse, AR/VR, and IoT are the major contributors to this disruption and help banking and financial institutions to offer innovative solutions and explore new ways to engage customers. To best use these technologies and understand their complete potential, it is best to connect with a reliable and experienced fintech app development company.

Such a technology partner can not only help you with building a new banking solution/app from scratch, but also upgrade your existing solutions with the latest technology to deliver better banking services, make these services accessible anywhere anytime, and boost profitability.

Frequently Asked Questions

In simple terms, the digital transformation of traditional banks includes integrating technology into conventional banking systems to enhance and streamline banking processes, boost customer experience, improve operational efficiency, and stay competitive in the market.

Banks can leverage digital transformation by adopting digital banking platforms, building mobile banking applications, implementing AI virtual assistants, automating banking operations, choosing robust security measures, and getting data analytics.

Some outstanding benefits of digital transformation in banking are:

– Improved customer experience

– Enhanced operational efficiency

– Increased data security

– Faster and secure transaction processing

– Cost reduction

– Data-driven data analytics

– Personalized banking services

– Adherence to compliance

– Innovation in product offerings

– Better risk management

– Enhanced decision-making