For any business, fraud is the major setback that affects its financials, productivity, and more importantly, its reputation in the market.

According to the ACFE Report, U.S. businesses lose an average of 5% of their gross revenues to fraud.

The same report highlights that private companies and small-scale businesses rank highest in occupational fraud frequency at 42% compared to large corporations, government, and non-profit organizations.

This creates the need for companies to invest in developing high-end fraud detection systems that detect and alert about fraud in advance to avoid such situations.

Businesses, especially the non-technical ones, often struggle to develop the right fraud detection systems.

Hence, we have provided a comprehensive guide that can help you with developing fraud detection systems so that you can safeguard your business from potential fraud and its significant damages. So, without any delay, let’s start.

Types of Frauds

Before starting the conversation about fraud detection systems, you need to understand the different types of fraud. Let’s explain the same:

1. Financial Fraud

Financial fraud is the most common type of fraud in businesses. It is finance-related, such as unauthorized use of credit cards to withdraw money, or providing false details to banks and financial institutions to obtain loans, eventually leading to defaults.

2. Identity Fraud

This type of fraud is related to misusing identity information to commit further fraud. It can be stealing someone’s personal information to make unauthorized transactions or to create fake bank accounts for money laundering.

3. Cyber Fraud

Also known as online fraud, cyber fraud is hacking the data system to steal crucial information or adding malicious software that blocks access to computer systems for a certain amount of money in return.

4. Corporate Fraud

Corporate fraud usually consists of making changes in financial statements to show false losses and avoid taxes. It also involves bribery and corruption-related fraud that affect businesses significantly.

Moreover, sharing internal information with others is also a type of fraud that falls under the corporate fraud category.

5. Employment Fraud

Last but not least, there is employment-related fraud, such as adding false qualifications or experience on a resume and manipulating payroll processes to gain extra compensation.

So, these are the major types of fraud that affect businesses in different ways. But, how can these be prevented? The answer is simple, by implementing fraud detection systems in businesses. Read further to understand about them in detail.

Fraud Detection Systems: Your Ultimate Weapon to Prevent Fraud

Fraud detection systems are applications, software, or platforms, powered by advanced AI and machine learning algorithms, that identify unusual patterns in the data and alert in real-time with detailed reports.

These fraud detection systems play a significant role in detecting and preventing fraud. That is why businesses spend much of their profits on building these systems. According to reports, on average, mid-sized companies and small businesses spend 11% and 6%, respectively, of their annual revenue on fraud prevention.

The AI developers train the fraud detection systems with advanced machine learning algorithms, that identify the usual activities in the data and alert about the potential fraud.

Common Techniques Used by Fraud Detection Systems

The following are the common techniques leveraged by fraud detection systems to detect and prevent fraudulent activities:

1. Rule-Based Detection

In this technique, predefined rules are set, and when these rules are violated, the system flags it as suspicious activity.

2. Anomaly Detection

This technique identifies the abnormal change in the normal behavior of the user. For instance, if a user withdraws more than the usual withdrawal amount, the fraud detection algorithms see it as a potential fraud.

3. Machine Learning Models

The fraud detection algorithms are trained using past data to recognize unusual patterns that indicate fraud.

4. Behavioral Analytics

It is one of the most commonly used techniques for fraud detection. It alerts about sudden changes in behavior, such as logging in via a new device or location, in real time.

5. Identity Verification

In this technique, identity metrics like biometrics and multi-factor authentication are used for a person’s identity verification.

6. Data Mining

The fraud detection systems analyze large datasets and identify hidden patterns that show signs of fraudulent behavior.

7. Predictive Analytics

Last but not least, the predictive analytics technique is used to predict future potential fraudulent activities, by carefully evaluating the past data. It allows taking proactive measures to prevent fraud beforehand.

You can use any one of these or combine various techniques to empower the fraud detection systems for your business. Let’s proceed to learn how to develop a fraud detection system.

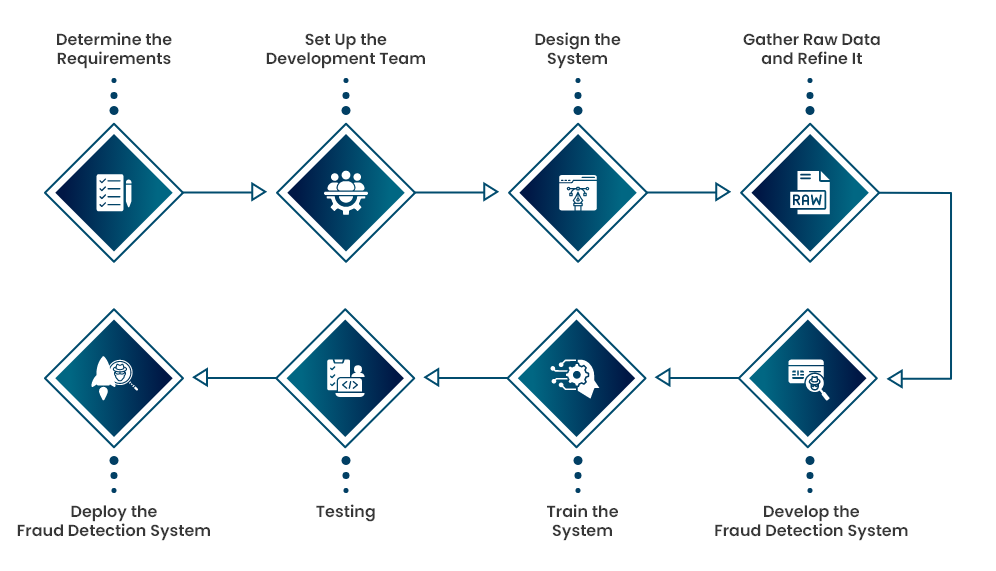

Step-By-Step Guide for Fraud Detection System Development

The following is your comprehensive guide for developing a fraud detection system tailored to your specific needs.

1. Determine the Requirements

Before starting to develop the fraud detection system for your organization, determine its role and what purposes it serves. Will it detect financial fraud, or be used to detect cyber or identity fraud?

Also, ensure the programming language and other technologies you are going to use for the fraud detection system development. All these will help you in the upcoming stages of development.

2. Set Up the Development Team

Developing a custom fraud detection system for a business requires years of experience and deep knowledge and expertise in artificial intelligence, machine learning, software development, predictive analytics, etc.

Thus, we advise you to hire top AI developers or outsource the project to a leading AI development company, whatever suits best for you.

3. Design the System

After setting up for development team, design the fraud detection system with the help of experienced designers. You must keep in mind to make an easy-to-use fraud detection system that anybody can use.

4. Gather Raw Data and Refine It

Fraud detection systems are trained on data, thus it is crucial to train the algorithms on high-quality data.

If you train it using low-quality data (data with irregularities and mistakes), it will show poor results accordingly. Hence, gather raw data from various sources and refine it to make it high-quality.

5. Develop the Fraud Detection System

While refining data, engage your development team to build the fraud detection system. Code the system’s backend and integrate advanced machine learning algorithms that will detect and alert about fraudulent transactions or activities.

6. Train the System

Post-development, train the fraud detection system with high-quality refined data.

Always remember to use high-quality data for training, otherwise it will affect the detection systems’ performance.

7. Testing

After training, your fraud detection system is ready for use. However, it will be a good decision to test it before deploying it.

Hence, test the system by attempting an unauthorized access fraud, such as showing a wrong identity (in case of identity-related fraud detection).

Or, try to access your business’s database (in case of cyber fraud detection) to test the fraud detection system.

8. Deploy the Fraud Detection System

Once you test it and everything is working fine, deploy the fraud detection system to detect fraud.

Also, instead of deploying it in the full environment, deploy it in a small portion and monitor its performance. If it works well, extend its deployment to the whole system.

By doing this, you can ensure the fraud detection system is perfectly aligned with your specific requirements.

So, this is how you can develop a fraud detection system for your business. However, if you need professional assistance with your fraud detection systems, feel free to contact us.

Use Cases of Fraud Detection Systems in Various Industries

In this section, you will explore how fraud detection systems are used in various industries:

1. Banking and Finance

Let’s start with an industry where most fraud occurs; banking and finance. Leading banks and financial institutions use custom fraud detection systems to detect fake checks, unauthorized credit card purchases, and money laundering.

Moreover, banks also use detection systems to verify the identities of customers during international payments and cash withdrawals. Furthermore, they also use detection systems to analyze financial reports to detect and prevent internal fraud cases.

2. Insurance

Insurance is another industry that leverages fraud detection systems to prevent false claims.

Powered by high-end algorithms, fraud detection models in insurance are used to analyze claims data and prevent fraud, such as staged accidents or inflated medical bills.

Moreover, these systems are used to screen people applying for insurance policies to detect false information provided by them.

3. Government and Public Sector

You must have heard about public scams in government and public sectors. They are majorly tax fraud and corruption-related scams.

To tackle these kinds of fraud, governments implement fraud detection systems to prevent tax evasion and fraudulent tax refund claims.

4. Healthcare

Hospitals and healthcare firms use fraud detection systems to detect and prevent overbilling, upcoding, or billing for services not rendered.

Moreover, these systems are used to monitor prescription drug transactions to identify unauthorized prescriptions or doctor shopping behavior.

5. Retail and E-commerce

In retail and e-commerce, fraud detection systems are used to tackle customers who try to return stolen or used items and ask for refunds.

Furthermore, these systems are used to prevent fraud by evaluating inconsistencies in inventories, or order-related issues ( customers ordering items more than usual consumption).

Hence, these are the top use cases of fraud detection systems in different industries.

Conclusion

Fraud in business has adverse effects, not only on the business itself but on the world economy as well. Fraud affects the financials, decreases productivity, demotivates employees working there, and ruins its brand image. Also, it affects its share prices, demotivating the investors and stakeholders.

Overall, fraud is not at all good for any business. Hence, every business must leverage fraud detection systems to detect and prevent fraud before it affects the business.

Therefore, if you also want to make your business fraud-proof, reach out to Quytech, the leading AI development company, having 12+ years of experience developing fraud detection systems tailored to the specific needs of a business.

Click here to connect with our experts now.

Frequently Asked Questions

Here are some frequently asked questions related to fraud detection system development.

Q1. Why does a business need a fraud detection system?

Businesses need fraud detection systems to detect fraudulent activities and transactions and take preventive measures before they have a severe effect on them.

Q2. How does a fraud detection system work?

Fraud detection systems leverage AI and machine learning algorithms to detect abnormal patterns and alerts about suspicious activities, that may lead to fraud.

Q3. Can I develop a fraud detection system?

Yes, you can reach out to Quytech to develop a custom fraud detection system tailored to your business.

Q4. How long does it take to develop a fraud detection system?

It depends on the complexity of development. However, it takes around 5-10 months to build a fraud detection system.