Personal finance app development has opened up new possibilities for creating tailored apps aimed at offering a user-friendly solution to individuals struggling with financial management issues.

Earlier, people used to track their incomes, expenses, and budgeting in notebooks or used Google Sheets to track and manage their finances. Now, personal finance applications have replaced these old-school methods.

People like modern finance management mobile apps with cutting-edge features and functionalities. Thus, the growth of these apps is going to rise exponentially.

Studies show that the global personal finance software market size will reach a valuation of $1.80 billion by 2030, with a CAGR of 6.1%.

Source: nextmsc

Considering the growth in the future, developing a custom personal finance app can do wonders in terms of business perspective. Thus, if you want to build a personal finance app, this blog is worth a read.

You will get a complete personal finance app development guide with a list of advanced features and monetizing strategies to unlock new revenue streams. So, let’s get started.

Top Benefits of Developing a Personal Finance App

Developing a personal finance app that helps users track and manage their finances provides various benefits. Here are some of them:

- Helps Users Manage Finances

Effective financial management is a paramount concern of most people worldwide. People struggle hard to manage their finances. So, by developing a personal finance mobile application, you can provide your users with the ultimate solution to track their income and expenses and allow them to prepare budgets accordingly.

- Data Insights

Using the data from a personal finance application, you can understand your user’s financial goals, preferences, spending habits, etc. Later, you can use this data to provide services your user may require.

For instance, you’ve noticed that most of your users tend to spend their income by the middle of the month. So, you can provide them with instant loans with interest. This data-driven insight enables you to offer another service (instant loans) to users.

- Additional Source of Revenue

Personal Finance App development also lets you generate additional revenue by monetizing it or selling other services. You will read about the monetizing strategies later in the same blog, thus keep reading it further.

By selling other services, you can earn additional income, such as interest from instant loans, commission from affiliate product selling, and collaboration fees from partnering up with financial institutions.

- Wider Reach

By developing personal finance mobile software, you can reach new users beyond the boundaries. You can tell more people about your business and the services you offer, generate more revenue, enhance your user base, and ultimately grow your brand image.

- Competitive Advantage

The demand for personal finance apps and solutions is high worldwide. Thus, developing a mobile app for personal finance management will help you gain more users and grow your business.

This way, personal finance app development will give you a competitive advantage in the market.

So, these are the top benefits of developing personal finance apps. Now, read ahead to delve into its development process.

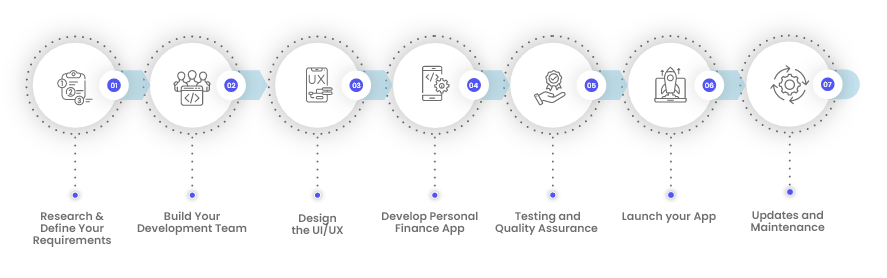

Personal Finance App Development Process

This section contains the development guide for building a custom personal finance mobile application.

Step 1. Research and Define Your Requirements

Researching the market thoroughly is the first step to developing a personal finance app. Analyze the types of personal finance apps – Simple and Complex personal finance apps.

Understand their workings, features, and what value they provide to the users. After your research, start working on your personal finance application. Note down the features and functionalities you want to integrate into your mobile app.

Step 2. Build Your Development Team

After researching your competition, build your development team that will help you develop a personal finance app.

You can create your in-house development team consisting of a project manager, native and cross-platform app developers, UI/UX designers, testers, and more.

Moreover, you can also hire the best mobile app development company to build your personal finance app.

Step 3. Design the UI/UX

Once you build your mobile app development team, start designing the UI/UX of the personal finance app.

Create an intuitive and easily navigational user interface with clear icon designs, font, and color combinations depicting your brand image.

Keep the UI/UX simple so your users do not find difficulty accessing information, tracking expenses, and managing budgets.

Step 4. Develop the Personal Finance App

Begin the development stage of the personal finance app with your team of mobile app developers. Develop the front end and back end of the application simultaneously to ensure optimal development.

Also, integrate cutting-edge features, such as captivating charts and graphs, and functionalities to provide your users with an enhanced experience while using your app.

Step 5. Testing and Quality Assurance

Post-development, test your personal finance app to check all the functionalities are working well. You must check your app on various devices to ensure it is providing a consistent user experience on different screen sizes.

Step 6. Launch your App

Once you test the app, launch your personal finance app for public use. Publish your app on the App Store and Play Store. Market them using app store optimization strategies.

You can also use different methods to market your application, such as advertisements, influencer marketing, SEO, and more.

Step 7. Updates and Maintenance

Personal finance apps require regular updates and maintenance to function well. Thus, it is crucial to update your app with new features, fix bugs, and improve the user interface based on your user’s feedback.

So, this is how you can develop a custom personal finance application that helps people track and manage their finances and prepare budgets. Now, let’s move forward and explore the features of a top personal finance mobile app.

Top Features of Personal Finance App

Here are the top features you can integrate into your personal finance mobile application:

- Easy Sign-Ups

Your personal finance app must have an easy sign and account creation process. Users must be able to create their profiles by adding basic details, such as name, email, date of birth, etc.

- Account Aggregation

This feature allows users to add their financial accounts from different institutions and set payment modes, such as debit/credit cards, net banking, digital wallet payments, etc. all in one place for a comprehensive view of finances.

- Expense Tracking

The expense tracking feature will allow your users to monitor their expenses. They can calculate where they are spending and how much they are spending.

- Budgeting Tool

This feature will allow your users to set budgets for different expenses and when the limit is crossed, they receive an alert notification.

- Bill Payment Reminders

Bill Payment Reminders send reminder notifications and help users avoid late payments.

- Financial Reports

The ‘Financial Reports’ feature allows users to generate financial reports based on the data they entered into the application. It helps them understand their overall financial health.

- Goal Setting

The ‘Goal Setting’ feature will help your users set their financial goals and track their progress towards them.

- Tax Optimization

This feature helps users optimize their taxations. Using this feature, users can reduce their overall taxes.

- Generative AI-enabled Chatbots

The chatbot powered by Generative AI can offer real-time responses 24/7 by understanding the client’s queries.

- Security Features

Protecting the financial data of users must be your top priority. Hence, you can add robust security features, such as end-to-end encryption, two-factor authentication, and biometric login, to protect users’ sensitive financial information and win the trust of your users.

So, these are the best features to add to a personal finance application. You can also integrate these into your app. If you require any assistance regarding feature integration, feel free to reach out to our team.

Technology Stack for Building a Personal Finance App

Here is the recommended technology stack for developing a top personal finance mobile application:

| Purpose | Technology Stack |

| Frontend development | React Native / Flutter |

| Backend development | Node.js / Python (Django or Flask) |

| Database management | PostgreSQL / MySQL / MongoDB |

| Data visualization | D3.js / Chart.js / React-vis |

| Real-time data synchronization | WebSockets / Firebase Realtime Database |

| Security measures | SSL / TLS / Encryption |

| Cloud storage | AWS S3 / Google Cloud Storage |

| RESTful API development | Express.js / Django REST Framework |

Please note this is a recommended technology stack to build a personal finance app. You can use other technologies according to your business requirements.

How to Monetize a Personal Finance App?

As a business, you want to get returns on your investment in personal finance app development. Hence, you need to monetize your app to generate revenue from it.

Here are some strategies you can implement to monetize your personal finance mobile application.

- In-App Advertisement

It is the most common strategy to monetize your personal finance application. You can charge from other businesses to run their ads in your application. But remember not to overdo it, otherwise it will affect the user experience.

- Freemium

Another strategy to make money from your personal finance app is a freemium model. You can provide basic features for free, and for advanced features, such as financial reports, users need to pay a specific amount.

- Data Monetizing

You can also use the ‘Data Monetizing’ strategy to generate additional revenue. But you must be transparent about these policies in the terms and conditions you offer to your users while signing up, and you must have your user’s consent to share their data.

- Affiliate Marketing

You can also collaborate with other brands to sell affiliated products and services on your platform and earn commissions. You can partner with instant loan providers or credit card companies to sell their services through your app and earn a commission in return.

- Subscription Model

This strategy will help when you have a strong and loyal user base. You can make your personal finance app completely paid. Your users need to subscribe to your app to use it. This way, you can make additional revenue.

So, these are the best monetizing strategies for a personal finance mobile application. You can use either of them or two or more to generate additional revenue.

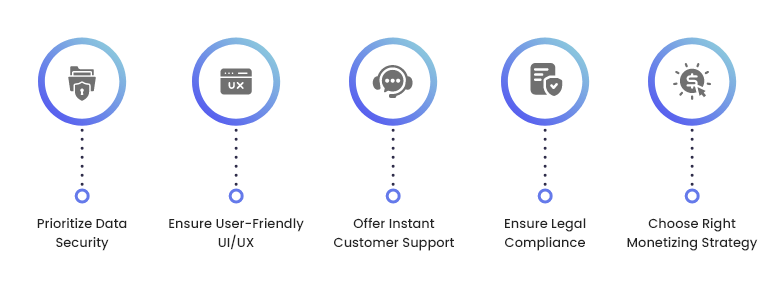

Key Considerations While Developing a Personal Finance Application

There are a few key considerations that you must keep in mind while developing a personal finance mobile app or software.

- Prioritize Data Security

Financial data is always at risk of being stolen. It is why banks and financial institutions invest millions of dollars in cutting-edge technologies, such as Blockchain technology, to protect data from unauthorized access.

While developing a personal finance app, you must implement advanced security measures, including biometric authentication, end-to-end encryption, and frequent security audits to tackle unwanted hacking challenges and win user’s trust.

- Ensure User-Friendly UI/UX

An intuitive UI/UX is necessary to attract and retain users for your personal finance app. If you create a cluttered UI, users will lose interest and leave your platform.

Remember the three-tap rule, according to which users get the information they are looking for in just three taps. Create a well-structured UI design to provide an extraordinary experience to your users.

- Offer Instant Customer Support

Many personal finance applications have slow customer support services that often irritate the user. In the era of automated chatbots, you must provide instant responses to user queries.

You can leverage Generative AI-powered chatbots that can understand user queries using machine learning capabilities and respond accordingly around the clock.

- Ensure Legal Compliance

Another key consideration to keep in mind is that personal finance must be compliant with rules and regulations. These may include GDPR, CCPA, and other financial industry standards.

The mobile app developers must develop the finance app while considering these regulations and update them frequently. Staying updated with relevant laws and regulations is crucial to mitigate legal risks and maintain users’ trust.

- Choose the Right Monetizing Strategy

Choosing the ideal model when monetizing your personal finance mobile application is crucial. Most businesses choose the wrong monetizing model to make more money, but it fails.

Thus, you must choose the right monetizing strategy that suits well with your app. For instance, you can prefer freemium over ads because ads may irritate the users and make them leave your app.

On the other hand, there is a high chance people will pay for advanced functionalities for using your personal finance app. You must consult a leading Fintech app development company to decide on the ideal monetizing strategy.

Top Personal Finance Mobile Apps

Below are the best personal finance mobile apps available in the market.

- YNAB

YNAB stands for You Need A Budget. As the name suggests, YNAB is one of the popular personal finance and budgeting mobile applications that help users track their income and expenses and prepare budgets for their short and long-term financial goals.

Downloads: 1M+

- EveryDollar

Similar to YNAB, Every Dollar is also used by millions of people in planning and managing their budgets. Users can also track their expenses, and get insights into their spending habits.

EveryDollar works on the freemium model, meaning you get the basic features for free, and pay for the application’s full functionalities.

Downloads: 1M+

- Monarch

Last but not least, Monarch is another platform people prefer to track and maintain their personal finances. The application has a customizable dashboard, financial planner, and budget tracker, that helps users to keep a tight eye on their income and expenses.

Downloads: 50K+

So, these are the best personal finance mobile apps available in the market.

Concluding Thoughts

Personal Finance apps help people achieve their financial goals. In these digital times, most people have various means, such as tap-to-pay cards and digital wallets, and end up overspending.

Personal Finance apps, on the other hand, help them track their expenses and provide insights regarding their spending habits. Using these insights, they can spend wisely and save money to meet their financial goals.

Start Developing a Personal Finance App with Quytech

Quytech is a leading fintech app development company that has developed numerous mobile applications, and personal finance apps are also one of them.

The best thing about the company is its in-depth consultation sessions with clients where they understand the client’s requirements in depth. Quytech has a team of experienced mobile app developers with expertise in developing all kinds of finance mobile applications.

They leverage advanced tools and technologies that enhance the app’s capabilities and performance and provide users with elevated personalized experiences.

So, what are you waiting for? Visit: www.quytech.com and consult our team now