This blog is a comprehensive guide to blockchain in asset management. It highlights the benefits of asset tokenization, use cases of blockchain for asset management, and a lot more.

Among all the benefits rendered by blockchain, one of the biggest is asset management. Blockchain in asset management has revolutionized how people invest, trade, and manage their digital assets. The technology not only brings transparency but also ensures all the assets and their ownership-related records are stored securely.

Let’s dig deeper into this guide that is all about blockchain in asset management. Here, we have covered blockchain in asset management, its benefits, use cases, industry applications, and the entire stepwise implementation process.

Blockchain in Asset Management: What It is?

In simple words, blockchain in asset management refers to the implementation or use of blockchain technology to streamline the management of different digital assets. Blockchain leverages its decentralized and highly transparent system to store and track ownership of assets and transactions that happen over the network.

Key Components of Blockchain in Asset Management

Let’s dig deeper into the critical components of blockchain in asset management:

- Distributed Ledger: Blockchain’s distributed ledger eliminates the need for a central authority, like a bank, to control and conduct transactions. The records of transactions are securely shared and synchronized across different computers within one blockchain network.

- Immutable Nature: Data, related to the ownership and transactions, recorded or stored on the blockchain cannot be modified or removed.

- Cryptography: Blockchain employs robust encryption methods to ensure the end-to-end security of data and transactions. These techniques keep cyber attacks, like data breaches and fraud at bay.

- Smart Contracts: Smart contracts are the building block of the blockchain. These self-executing contracts include terms or conditions that should be met in order to perform specific operations, such as transactions or payments.

- Tokenization: It means asset digitization; tokenizing real-world assets, like art, real estate, books, and more make them accessible to global users. It increases liquidity and facilitates effortless trading.

How Does Blockchain in Asset Management Work?

Let’s understand the working for assets management in Blockchain:

- Registering Assets: Firstly, all assets are registered on the blockchain. They get a unique digital identity.

- Recording Transactions: In the next step, transactions associated with each asset are recorded or stored on the blockchain.

- Executing Smart Contracts: Smart contracts come into the picture and automate operations like payments, verifying compliance adherence, and more.

- Accessing Data: It involves allowing authorized users to access the blockchain network to check required information, such as transaction records, asset ownership details, and more.

5 Benefits of Asset Digitization in Blockchain

Below are some blockchain in asset management benefits that might surprise you:

#1 Enhanced Security

Blockchain’s immutable nature ensures the next-level security of digital assets. That’s because data, associated with ownership and transactions, recorded and stored on the blockchain network cannot be tampered with by users. This eliminates the chances of data breaches, unauthorized access, and fraud.

Apart from this, blockchain leverages robust data encryption techniques to ensure the security of transactions. These techniques make it extremely difficult for users to intercept information.

#2 Increased Transparency

Transactions happening and recorded on a blockchain network can be publicly accessed (with different degrees of privacy depending on the particular blockchain network in which they were conducted). It increases transparency among stakeholders. Having a single source of truth also minimizes information asymmetry and improves transparency and trust.

#3 Improved Efficiency

Smart contracts, the core or foundation of the blockchain, automate manual and time-intensive operations such as compliance checks, trade settlements, payments, and others. It reduces overall operational costs, enhances efficiency, and reduces human errors. Blockchain in asset management also streamlines processes and minimizes transaction times. It also facilitates real-time settlement of transactions.

#4 Saves Costs

It is one of the prime “blockchain in asset management” advantages enterprises look for. Asset digitization using blockchain reduces operational costs with automation backed by smart contracts. Moreover, the elimination of intermediaries also reduces the transaction fees that exist in traditional systems. Both of these costs reduce the overall costs, which is one of the primary goals of any business.

#5 Increased Liquidity

Blockchain facilitates seamless asset tokenization, which further brings fractional ownership and enhanced liquidity. With this, investors can easily explore and trade different assets without worrying about security. Moreover, blockchain-powered platforms and asset digitization also make it possible to trade assets anywhere at any time. In other words, investors get the flexibility and seamless access to international markets.

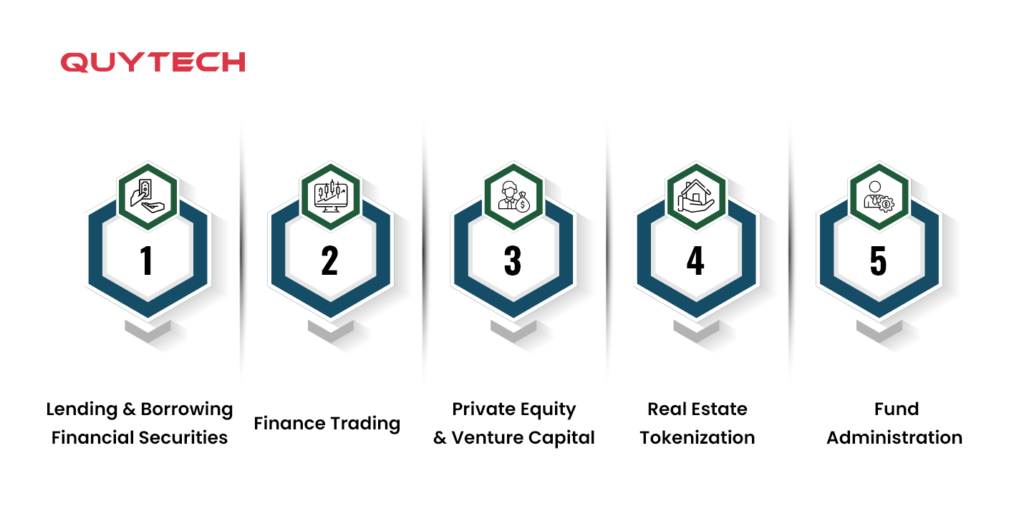

Use Cases or Applications of Blockchain in Asset Management

Now that you know enough about blockchain and asset management, let’s dig deeper into the use cases or applications of blockchain in asset management:

#1 Lending and Borrowing Financial Securities

It is one of the most common asset management blockchain use cases. Traditional systems require users to go through complex processes and pay hefty amounts for lending financial securities. Besides, manual reconciliation in these systems also leads to delays in settlement while increasing the chances of potential fraud.

Implementing blockchain for asset management can do wonders. Self-executing agreements, known as smart contracts within the blockchain, can automate loan agreements, interest payments, and more to save time, reduce dependence on human resources, save costs, and minimize counterparty risks.

For example, in the case of a hedge fund borrowing from an investment bank, a smart contract would automatically verify collateral adequacy, calculate and disburse loan charges, automate the return of sharing after loan maturity, and impose fines for late payments or returns.

#2 Finance Trading

The next prominent use case of blockchain and asset management is the seamless trading of finance. Global trade requires fulfilling complex documentation, needs a lot of time for the settlement, and involves high costs to be paid to intermediaries.

Blockchain creates a shared and difficult-to-tamper-with record of documents, such as the bill of lading (BoL) and letters of credit, required to facilitate trading. In addition, smart contracts automate operations like executing payments and releasing funds after the conditions that are defined in the contract are fulfilled. The whole process not only improves transparency but also minimizes the chances of fraud. Furthermore, it also expedites trading.

In the case when blockchain and asset management are used in the logistics industry, smart contracts automatically issues the payment to the exporter once the importer confirms receiving of goods.

#3 Private Equity and Venture Capital

Managing private equity and venture capital investments manually may involve various legal agreements. It also requires performing the time-consuming task of manually keeping and securing all records. Blockchain-powered solutions developed for asset management can streamline processes like fund administration, portfolio management, and investor relations.

With smart contracts, there is no need for manually executing any operations as it automates capital calls, distribution and management fee calculations, portfolio management, and other crucial tasks.

#4 Real Estate Tokenization

Real estate investments done via traditional methods come with a lot of barriers and complex ownership structures. With real estate asset tokenization that happens over a blockchain network, real estate properties can be made accessible to a wider range of investors, irrespective of their geographical location.

Global investors can invest in a property, buy tokens that represent their fractional ownership of that asset, and get a rental income. Smart contracts ensure that each investor automatically receives their share of rental income without going through any complex process.

Explore More: Guide to Real-World Asset Tokenization in 2025

#5 Fund Administration

With blockchain in asset management, fund administrations can be really simple and sorted. It requires performing tasks such as calculating net asset values, processing subscriptions, and managing investor data. All these operations can be automated by employing blockchain-powered smart contracts.

Industry-wise Use Cases of Blockchain in Asset Management

Let’s find out the use cases of blockchain in asset management across different industries:

- Finance

In finance, blockchain in asset management can automate loan agreements and loan settlements while streamlining trade finance by digitizing documents and automating payments. It can also be used in private equity and venture capital to manage fund administration, portfolio management, and other purposes.

- Real Estate

The real estate sector can benefit from asset tokenization for property tokenization, smart leases with automated rent payments, effortless property maintenance management, supply chain management, and other purposes.

- Supply Chain and Logistics

This sector can leverage asset tokenization for supply chain finance operations and streamline international trade transactions by automating various operations and digitizing documentation.

- Energy

Blockchain and asset tokenization have many applications in the energy sector. These use cases include renewable energy trading, energy trading and settlement, minimizing settlement times, and more.

- Healthcare

The healthcare sector can tokenize assets and leverage blockchain to track the movement of pharmaceuticals, manage and secure data, and other purposes.

Explore More: Role of Blockchain in Healthcare: Top Use Cases, Benefits, Future, and More

Apart from the aforementioned, blockchain for asset management has a myriad of use cases in real estate, supply chain, finance and banking, insurance, manufacturing, and other industries. To explore the best use case of blockchain asset management for your particular business, connect with a reputed blockchain development company or hire blockchain developers.

Get their consulting services will help you identify the business gaps that can be fulfilled by integrating blockchain for asset management.

This Might Help You Find a Reputed Technology Company: List of Top 20 Blockchain Development Companies in 2025 to Develop Secure Blockchain Solutions

Blockchain in Asset Management: How is It Done?

Here is a stepwise process of using blockchain in asset management:

Step1: Asset Tokenization

Asset tokenization means representing real-world assets, such as stocks, bonds, art, real estate, and more as digital tokens on a blockchain network. Whatever asset needs to be digitized is evaluated to decide its value. Once the value is determined, a token representing the fractional ownership of that particular asset is issued on the blockchain. Once done, the smart contract is coded to automate managing the ownership rights of the assets.

Read More: Real Estate Tokenization Guide for Investors & Asset Owners: Challenges, Benefits & Future

Step 2: Smart Contracts Development

These self-executing contacts on the blockchain are programmed with certain terms and conditions that need to be fulfilled for executing certain operations. In this step, smart contracts are designed for different tasks depending on the use case that a business wants to achieve. It could be for trade settlements, payment processing, compliance verification, and more. Once designed, the smart contracts are launched on the blockchain network.

Step 3: Trading Tokenized Assets

The next step is to trade tokenized assets using a decentralized platform or DEXs. Firstly, the assets are listed on the DEX platform, and investors interested in buying one or multiple tokens that represent assets can participate in trading, without needing any intermediary. The DEXs platform leverages decentralized order books to facilitate trades. It is the smart contract that ensures all the conditions are met to facilitate the trade.

Step 4: Storing and Managing Asset-related Records

In this step, relevant data associated with the asset’s token’s ownership, transaction history, and asset is stored and managed on the blockchain network. Once stored, authorized parties can access and verify this data, which increases transparency and builds trust.

Step 5: Integrating with Existing Infrastructure

The last step involves integrating blockchain technology into existing technical infrastructure or platforms that are being used for asset management. This is done by creating APIs that facilitate seamless communication between existing platforms and blockchain. The step also incorporates migrating relevant data from the existing system to the blockchain.

The Bottom Line

Blockchain technology has transformed asset management, making it easier for people to tokenize their assets and enhance their accessibility and security. This blog highlights exciting advantages, use cases, and working of blockchain in asset management. It also includes how to implement blockchain for asset management.

If you want to leverage the technology for this particular use case, partner with a reliable blockchain app development company or hire blockchain developers with similar experience. Choose your technology partner carefully to get the most blockchain technology for asset tokenization and management.