Financial advisors need to deal with complex, high-stakes numbers every day, and they cannot afford a minor mistake. This is because these are not just random numbers but the numbers on which their clients’ wealth depends.

A simple mistake by financial advisors in analyzing and calculating these numbers can result in huge losses to their clients. Now, at this moment, you are probably thinking about how financial advisors manage their work effectively without making mistakes.

The answer is that they rely on cutting-edge technologies, including emerging technology called Agentic AI. It’s fast, reliable, and already reshaping the future of financial advisory services.

Financial advisors across the globe have started using Agentic AI to streamline their work, analyze financial data and economic trends, and identify and solve errors. And the best part is that it does not require manual intervention.

According to Market.us, the Agentic AI for Financial Services Market is projected to be worth $80.9 billion by 2034, growing at a CAGR of 43.8% from 2025 to 2034.

Source: Market.us

If you are also a financial advisor or run a financial advisory firm, then this blog is a must-read for you. In this blog, we have explained the role of Agentic AI in financial advisory and how financial advisors can use it to enhance their productivity and save time. So, let’s start.

A Brief Introduction to Agentic AI

Before moving forward, let’s first understand briefly about the Agentic AI. Agentic AI is an AI-powered software or solution designed to handle complex tasks, make independent decisions based on its experience, and adapt to evolving situations.

Just like humans think logically and take actions keeping the goals and situations in mind, similarly, Agentic AI interprets the objective, understands the context, and takes meaningful actions to achieve the desired outcome.

In fact, it goes beyond human intelligence and considers all possible situations/factors that are difficult to achieve by humans.

Agentic AI is developed using cutting-edge AI technologies, such as machine learning, generative AI, adaptive AI, and others, making it capable of improving its decision-making abilities and performance and refining its approach to complete a task over time.

How Agentic AI is Different from AI Agents

Many people think that Agentic AI and AI agents are the same concept, but in reality, these two are similar but not the same. Here is a brief comparison between Agentic AI and AI agents based on their working models, capabilities, and more.

| Aspect | Agentic AI | AI Agent |

| Definition | Agentic AI refers to autonomous systems that can set goals, plan, and act independently. | AI agents are software programs designed to respond to inputs and perform specific tasks. |

| Nature of Operation | Proactive—they identify tasks, initiate actions, and work toward achieving goals on their own. | Mostly reactive—they act when prompted or when a condition is met. |

| Autonomy Level | High autonomy—they can operate without continuous human intervention. | Limited autonomy—mostly task-bound and relies on human input. |

| Decision-Making Ability | Makes decisions through reasoning, context awareness, and strategic planning. | Follows pre-programmed rules or patterns from training data. |

| Task Complexity | Suitable for complex, multi-step, and evolving tasks. | Best for simple, repetitive, or linear tasks. |

| Interaction Style | Self-initiated—can trigger workflows, ask questions, or make recommendations proactively. | User-initiated—waits for prompts or inputs to act. |

| Learning & Adaptation | Continuously learns from outcomes and adjusts strategies or actions over time. | Some may use ML to improve, but typically don’t change behavior significantly. |

| Business Role | Drives business outcomes by orchestrating decisions, workflows, and actions. | Automates individual tasks or customer interactions. |

| Level of Intelligence | Moves toward general intelligence—can perform multiple, interconnected functions fluidly. | Generally, narrow AI—focused on a single function or task. |

| Examples | Financial advisor agents, AI autonomous research agents, and LLM-based assistants. | Chatbots, voice assistants (e.g., Alexa), basic trading bots, and recommendation engines. |

You might be interested in: AI Agents in Finance: Use Cases, Benefits, Challenges and More

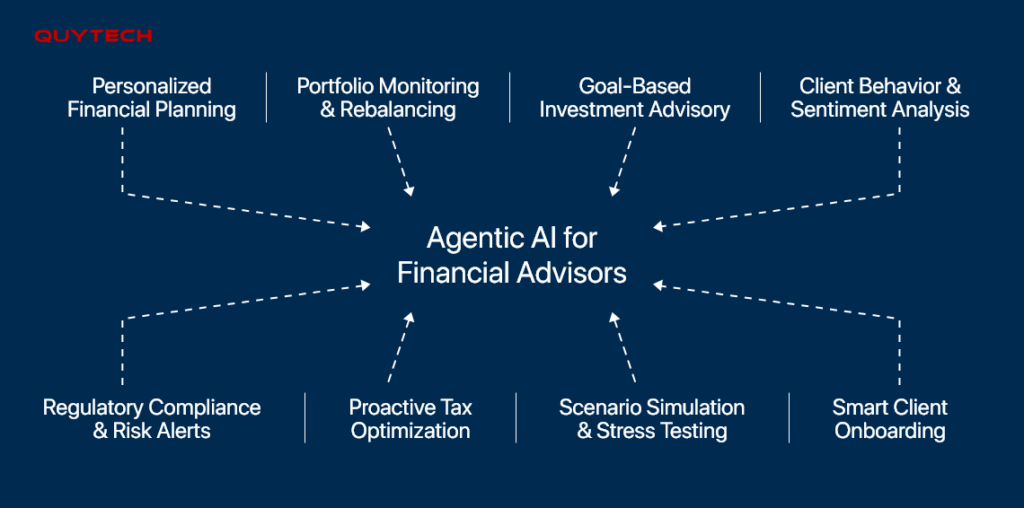

Top Use Cases of Agentic AI for Financial Advisors

Now, let’s explore the top applications of Agentic AI for financial advisors:

- Personalized Financial Planning

The first use case of Agentic AI is that it helps financial advisors with personalized financial planning. They handle various clients, and every client’s financial needs and goals are different. It makes it difficult for financial advisors to analyze each client’s financial data, analyze market trends, and plan accordingly.

However, by using Agentic AI, this complete financial analysis and planning gets streamlined. Agentic AI leverages its capabilities to perform the tasks and ensures that there will be no mistakes while planning. This reduces the effort to a great extent and enhances their productivity.

- Portfolio Monitoring and Rebalancing

Portfolio monitoring and reblancing are two other applications of Agentic AI in financial advisory. These intelligent Agentic AI solutions are used to continuously track a client’s investment portfolio, analyzing their asset performance, risk exposure, and market trends in real time.

Whenever the portfolio drifts from the target allocation or deviates from the client’s risk profile, the AI agent proactively suggests or executes rebalancing strategies, like buying underweighted assets or selling overexposed ones.

This alignment with financial goals, the Agentic AI, optimizes investment returns and mitigates risks without requiring manual intervention.

- Goal-Based Investment Advisory

Financial advisors use Agentic AI to provide goal-based investment advice to their clients. The latter technology helps to create and manage investment strategies tailored to an individual’s specific financial goals, for example, retirement, buying a home, or funding education.

The Agentic AI collects and analyzes the financial data of clients, like income, risk tolerance, timelines, and lifestyle preferences, to build a dynamic investment plan. This is different and more effective than traditional strategies as Agentic AI continuously monitors progress, adjusts asset allocation, and simulates future scenarios to keep clients on track.

Moreover, if a client’s goals, income, or market conditions change, the Agentic AI proactively restructures the plan. This personalized, adaptive approach enhances long-term success and delivers more meaningful, goal-aligned financial outcomes.

- Client Behavior and Sentiment Analysis

Client behavior and sentiment analysis using Agentic AI allows financial advisors to understand their clients better and respond to their needs in real time. The Agentic AI is used to analyze interactions and communication patterns of clients and their financial decisions across emails, messages, voice calls, and app usage to detect behavioral and emotional trends and signs.

Using these analyses, Agentic AI identifies signs, such as hesitation, dissatisfaction, or changing financial priorities, and flags concerns, suggests personalized solutions, or even initiates proactive outreach so that financial advisors can convert their potential clients into actual ones.

Additionally, Agentic AI also customizes communication styles so that it aligns with the clients’ sentiments to build trust and engagement. This deep behavioral insight provided by Agentic AI empowers financial advisors to offer timely, empathetic, and more effective financial guidance.

You might be interested in: How AI is Being Used in Trading? AI in Stock Trading

- Regulatory Compliance and Risk Alerts

Agentic AI is also used by financial advisors and firms to stay aligned with evolving regulatory compliance and industry standards. Agentic AI is used to continuously monitor transactions, portfolio activities, and client profiles against regulatory frameworks such as the SEC, FINRA, or GDPR.

Also, these AI solutions autonomously flag suspicious patterns, potential breaches, or anomalies, such as AML (Anti-Money Laundering) or insider trading risks, before they escalate.

In the financial advisory sector, Agentic AI helps in reducing legal exposure, enhancing transparency, and saving the time and effort of compliance teams by automating risk detection and audits.

- Proactive Tax Optimization

Another application of Agentic AI for financial advisors is proactive tax optimization and minimizing clients’ tax liabilities through intelligent, real-time strategies.

Financial advisors and firms leverage agentic AI in their systems to effectively review financial activities, such as investment gains/losses, income changes, and asset transfers, to identify tax-saving opportunities like tax-loss harvesting, deferring income, or optimizing capital gains.

Also, Agentic AI collaborates with tax software or professionals to generate reports and suggest actionable next steps to the financial advisors, helping them to retain more of the wealth of their clients, without misaligning with any tax regulations.

- Scenario Simulation and Stress Testing

Agentic AI is used by financial advisors to evaluate how a client’s portfolio or financial plan would perform under various market conditions and life events.

This AI-powered software runs simulations like market crashes, interest rate hikes, inflation surges, or job loss and analyzes the impact on clients’ investment returns, liquidity, and financial goals. Moreover, agentic AI not only analyzes outcomes using simulations but also provides risk-mitigation strategies, such as asset reallocation or emergency fund adjustments.

Agentic AI learns from historical data and real-time inputs and delivers insights that help financial advisors to prepare their clients for unexpected situations, make informed decisions, and create more resilient financial plans.

- Smart Client Onboarding

The last entry on the list of use cases of agentic AI for financial advisors is smart client onboarding. Agentic AI streamlines and personalizes the entire process of bringing new clients into a financial advisory firm.

Financial advisors deploy Agentic AI to autonomously gather the necessary data of their potential clients, such as identity documents, financial history, risk preferences, and goals, through secure digital interactions.

During the process, Agentic AI uses natural language processing to guide clients through forms, answer questions, and clarify terms in real time. Moreover, it also performs automated KYC and AML checks, ensuring regulatory compliance without manual errors or delays.

In this way, Agentic AI not only reduces onboarding time and enhances client experience but also boosts operational efficiency and builds trust and engagement from the very first interaction.

You might be interested in: Types of AI Agents: Use Cases, Benefits, and Challenges

Benefits of Agentic AI for Financial Advisors

The following are the top advantages of leveraging Agentic AI for financial advisors.

- Save Time on Routine Tasks

Agentic AI saves a significant amount of time for financial advisors by automating their daily work, like portfolio monitoring, report generation, and document management.

This reduces manual workload, speeds up operations, and allows financial advisors to focus more on client engagement, strategic planning, and growing their business rather than getting stuck with the administrative work.

- Eliminate Errors

Agentic AI executes tasks with algorithmic precision. Hence, it reduces the chances of calculation errors, missed deadlines, or data entry mistakes and ensures consistency in decision-making and compliance processes.

This helps financial advisors to maintain accuracy and establish more trust with clients for reliable, mistake-free financial guidance.

- Stay Ahead with Real-Time Insights

Agentic AI benefits financial advisors by helping them stay informed about the happenings in the finance world.

Agentic AI continuously scans financial markets, economic indicators, and news feeds to detect trends and risks and deliver these real-time insights and alerts in real-time.

These insights and real-time information help financial advisors to act swiftly, make well-informed decisions, and help their clients stay ahead in volatile market conditions.

- Enhance Client Experience

By leveraging agentic AI, financial advisors can strengthen client relationships through faster, smarter interactions.

These AI agents handle routine queries, deliver real-time market updates, and proactively suggest financial plan adjustments. With instant responses and 24/7 availability, they elevate the client experience and build lasting trust and satisfaction.

- Boost Business Scalability

Agentic AI can handle multiple client accounts, tasks, and updates simultaneously, making it easier to serve a larger client base without increasing overhead.

This scalable support structure empowers financial advisory firms to expand their services efficiently while maintaining high-quality, personalized experiences for each client.

Read Also: How to Create an AI Agent? Top Use Cases, Benefits, and Examples

How to Build and Implement Agentic AI for Your Financial Advisory Business

You can follow the given process to develop and implement agentic AI tailored to your business.

- Identify Goals and Use Cases

First, you need to define what you want the agentic AI to achieve. It could be automating client support, monitoring portfolios, or providing real-time investment advice. You must prioritize the applications of Agentic AI that deliver the most impact to your business.

- Design Agentic AI’s Architecture

Once you have identified the goals, outline the Agentic AI’s behavior, decision-making autonomy, and interaction model. Also, decide which technologies, like natural language processing, machine learning, generative AI, APIs, and data sources, it will leverage to function efficiently.

- Prepare and Train with Financial Data

Now, you need to gather relevant datasets that include historical financial data, client profiles, market trends, and industry regulations. After collecting them, use this data to train your Agentic AI for accurate analysis, recommendations, and compliance. Always remember to use high-quality data to train your Agentic AI.

- Integrate with Your Ecosystem

After training, integrate the Agentic AI with your existing systems, like CRM, portfolio management platforms, and communication channels, to enable seamless operation across your financial advisory workflow.

- Deploy, Monitor, and Evolve

Deploy the Agentic AI in phases, and start small. You need to continuously monitor performance, gather user feedback, and refine the system. Also, you must ensure that your Agentic AI is updated, aligning with compliances, security, and your evolving business needs.

Conclusion

Agentic AI is the intelligent solution and software designed to handle complex business workflows. In the financial advisory, these Agentic AIs can be used to perform various operations, such as providing advice for goal-based investments, analyzing clients’ sentiments and behavior, optimizing taxes, onboarding clients smartly, and complying with industry standards.

With Agentic AI, financial advisors can save time, eliminate errors, enhance client experiences, stay competitive with real-time insights from the finance world, and scale their business to new heights.

If you are also a financial advisor who wants to streamline work and enhance your client experiences, then reach out to Quytech, the best Agentic AI development company. We have developed and successfully deployed 100+ Agentic AI solutions for notable financial businesses and banks worldwide. For more information, please visit www.quytech.com.

Frequently Asked Questions

An AI agent is a system that perceives its environment, decides, and acts to achieve desired goals. On the other hand, agentic AI is the more advanced version of the AI agent as it is designed to show goal-driven behavior over time, often with the ability to reason, plan, and self-initiate actions.

Developing an agentic AI offers you various advantages, such as automating complex business workflows, making intelligent decisions, and improving efficiency, scalability, and client experiences.

The development time depends on factors like the complexity, integration, tech stack, level of autonomy required, development team, and more. Generally, it takes around 4 months to 10 months, or even more, to build an agentic AI for the finance industry.

Financial advisors can use agentic AI for performing tasks like automating financial planning, offering personalized investment advice, monitoring clients’ portfolios, ensuring compliance in real time, and more.

Yes, you can hire AI developers from Quytech to build agentic AI tailored to your business, industry, and target audience.

Quytech is a top agentic AI development company that has built 50+ agentic AI solutions for top industry verticals, such as finance, healthcare, manufacturing, logistics, and more.

Fill up this contact form and share your requirements, and our team will reach out to you at the earliest.